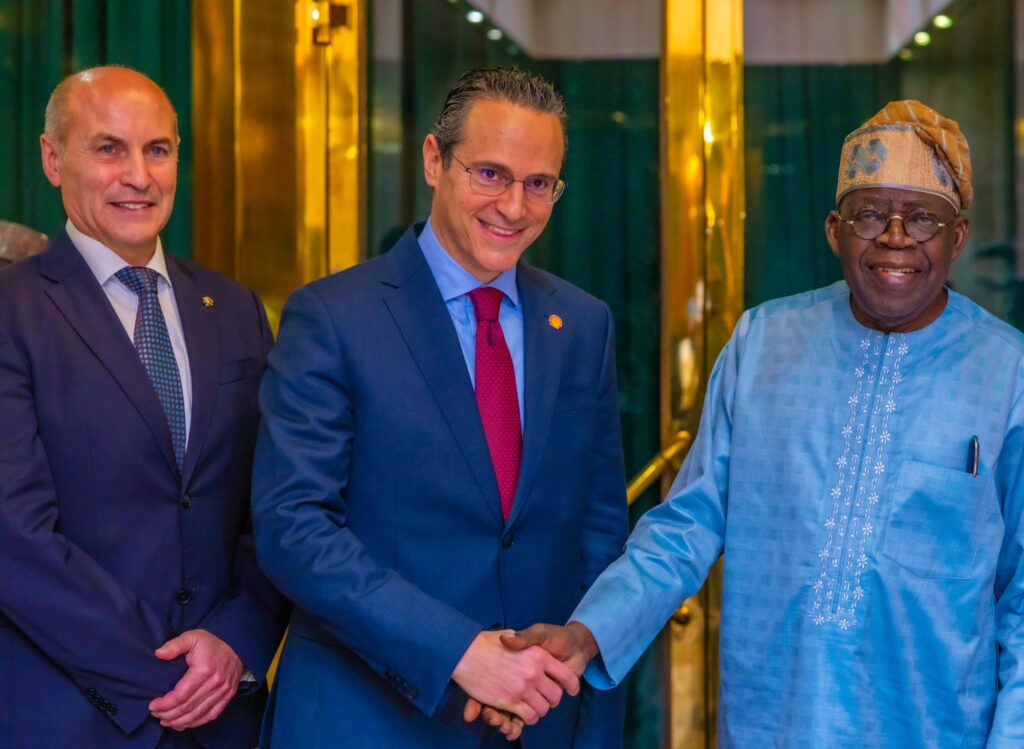

Shell CEO Hails Nigeria President Tinubu for $20bn Nigeria Energy Boost

Shell PLC Chief Executive Wael Sawan has publicly commended President Bola Tinubu’s administration for fostering the stable and professional investment environment that has unlocked Shell’s major renewed commitment to Nigeria, including a potential landmark $20 billion investment in the Bonga South West deepwater project—the largest single energy FDI in Africa in decades.

During a high-level meeting at the Presidential Villa, Sawan described a significant shift from previous challenges: “We have really been in a space where we are very keen to invest in Nigeria. But I would say this has not always been the case. Your leadership and your vision have created an investment climate over the last few years that… propelled us to invest.”

The Lebanese-born CEO, Shell’s first from outside its traditional Dutch-British leadership pool, singled out the exceptional calibre of Nigeria’s current energy leadership team—many of whom are former Shell executives—as world-class. “Your team are amongst the best that we are dealing with anywhere in the world, and that professionalism allows us to be able to have the confidence,” he stated, highlighting how this alignment has enabled long-term, multi-decade investment decisions.

The endorsement marks a dramatic reversal for Nigeria, which had previously seen international oil companies scale back or exit amid regulatory bottlenecks, delayed approvals, and stalled mega-projects. Tinubu’s direct engagement with Sawan, targeted executive orders, and investment-linked incentives have proven decisive in a fiercely competitive global capital landscape where jurisdictions vie aggressively for energy funding.

Sawan stressed the premium placed on policy stability for projects spanning 20–40 years: “Stability in today’s environment will honestly have a premium for corporates because we are investing not for one administration… we want to invest for 20, 30, 40 years.”

Shell’s confidence is demonstrated through concrete actions: the company recently acquired TotalEnergies’ stake in OML 118 (the Bonga block) to deepen its footprint, with Sawan affirming, “We bought it because we want to deepen further… But that, we think, is not enough. We think there is more to invest here.”

Nigerian National Petroleum Company Limited (NNPCL) Group Chief Executive Bayo Ojulari reinforced the point, noting intense global competition for capital—from Guyana to the Far East—and the broader economic ripple effects of such developments. Revived deepwater projects are expected to reactivate idle fabrication yards, create jobs across construction, supply chains, and fabrication, and support long-term industrial activity.

The Bonga South West project could serve as a catalyst for unlocking other stranded deepwater assets, including Chevron’s Zabazaba and Nsiko, ExxonMobil’s Bosi, and the Satellite/Ude fields, with combined potential output exceeding 580,000 barrels per day. Industry voices in Lagos view Shell’s endorsement as a powerful signal: “Nigeria is open for serious business again,” resonating in boardrooms worldwide.

As Nigeria positions itself to reclaim its status as Africa’s premier oil producer, the critical question remains whether these gains reflect enduring systemic reforms or exceptional high-level relationships. For now, Shell’s vote of confidence underscores the tangible impact of improved governance and investor-friendly policies on Africa’s energy future.